Leverage WhatsApp for Finance & Insurance

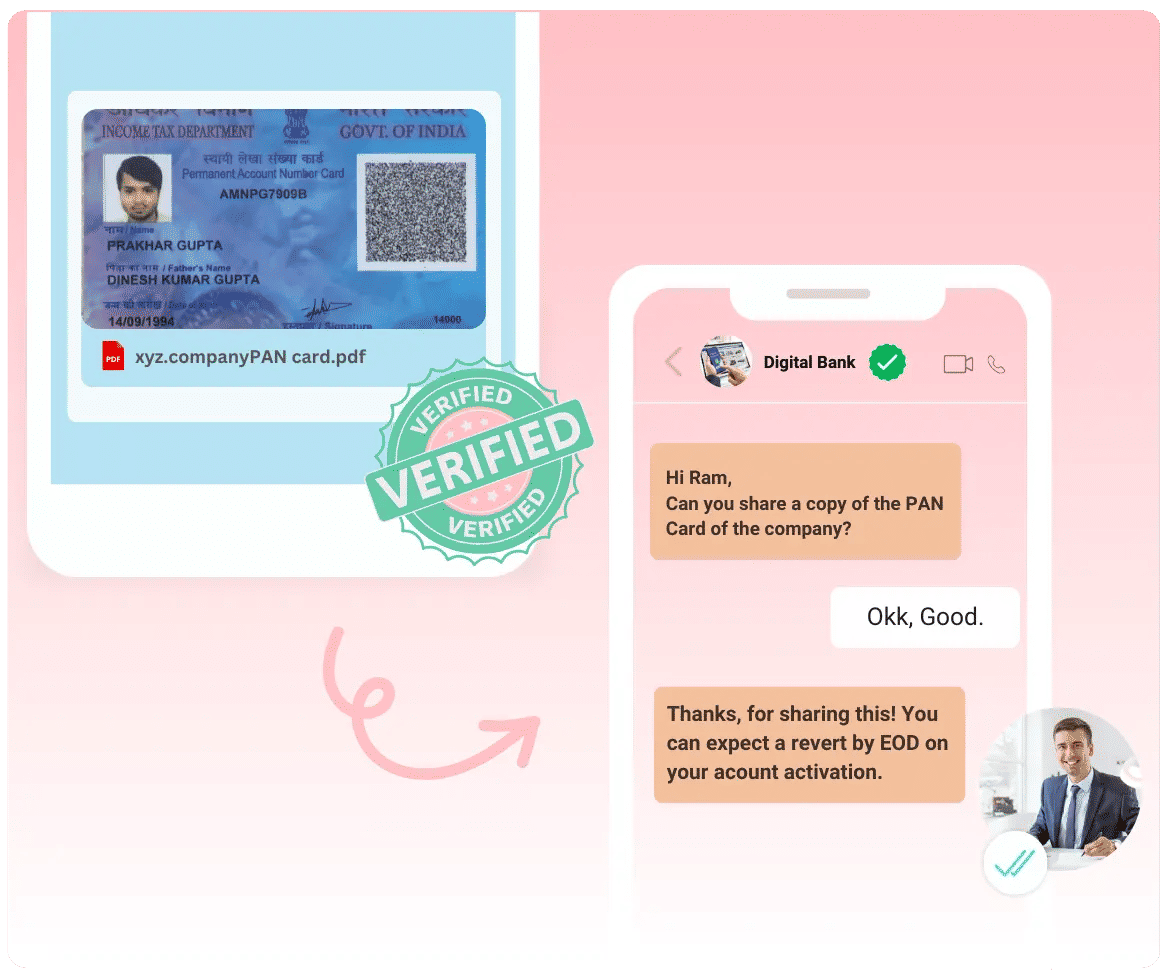

Carry out KYC processes like ID verification, document verification etc

Offer 24/7 support to clients via WhatsApp

Share invoices, e-policies, e-receipts with customers

Carry out KYC processes like ID verification, document verification etc

Offer 24/7 support to clients via WhatsApp

Share invoices, e-policies, e-receipts with customers

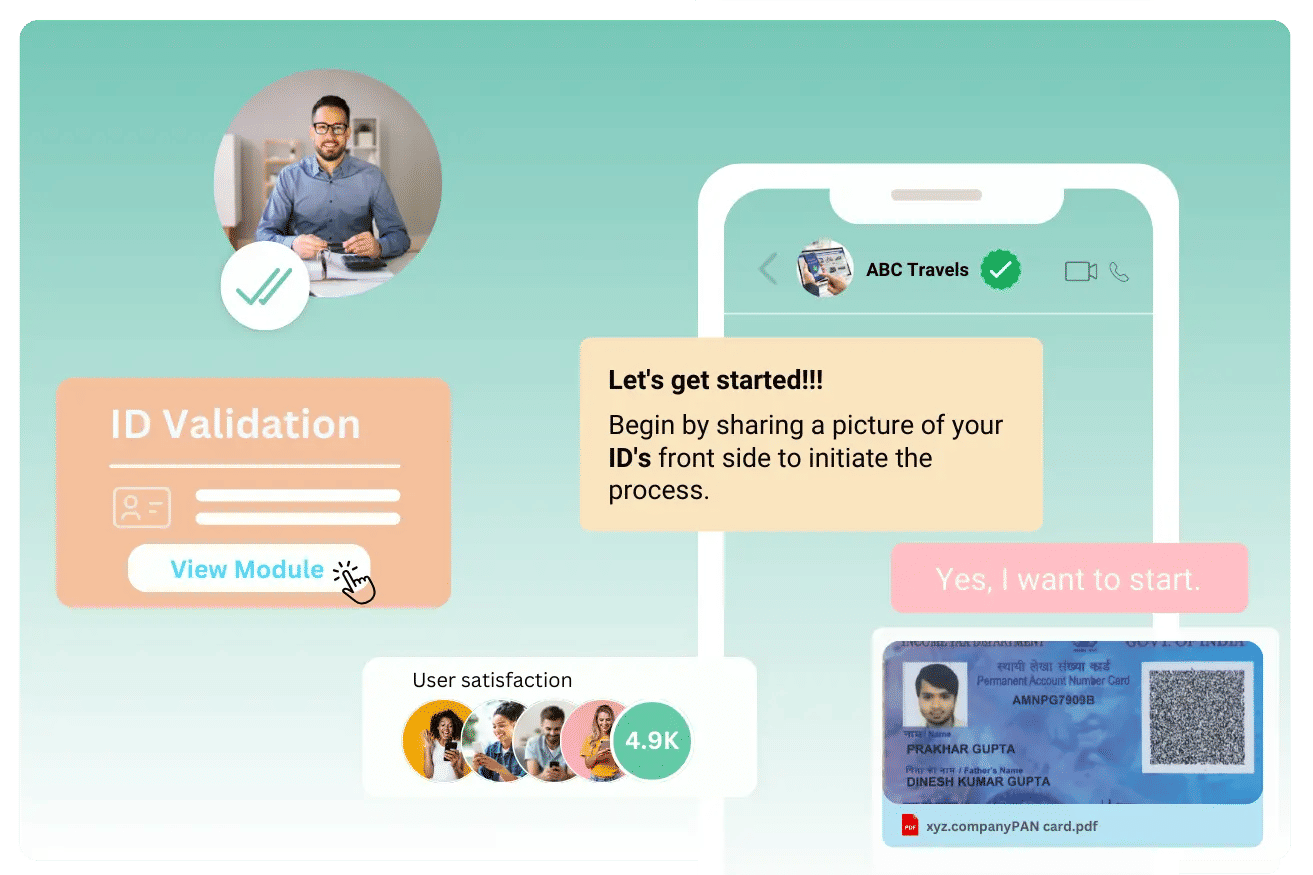

Make KYC simple with step-by-step guidance and collecting documents on WhatsApp.

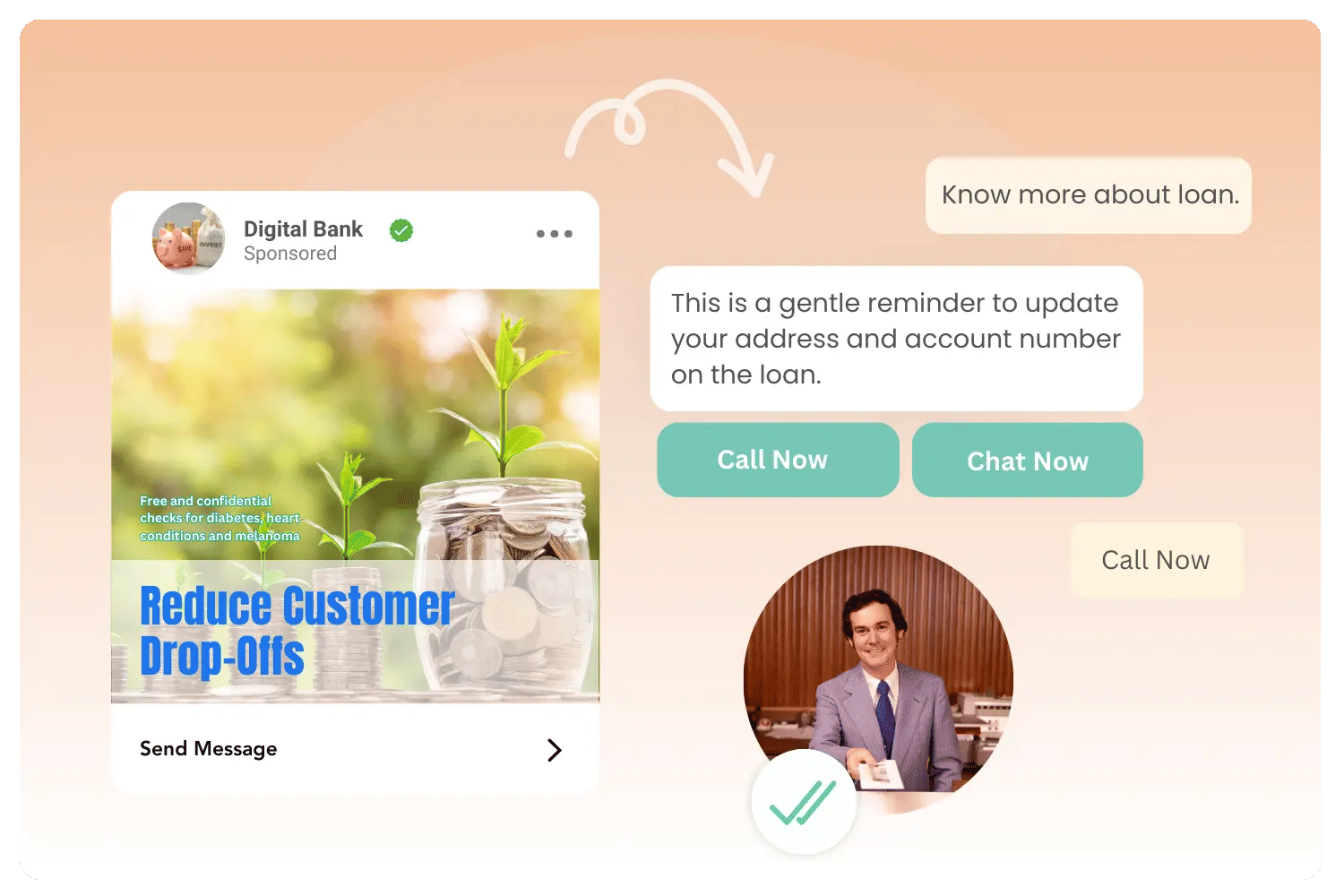

Use WhatsApp to ensure that customers stay informed about their financial transactions and obligations.

Simplify the onboarding process by replacing Complex form filling and document collection with effortless chat interactions

Facilitate KYC verification, customer onboarding, and activation through messaging, voice, and video. Achieve a significant 26% reduction in onboarding time

Download Our Exclusive Guide to Discover Ways to Boost Your Financial Success!.

Help new customers get started easily with interactive messages on WhatsApp.

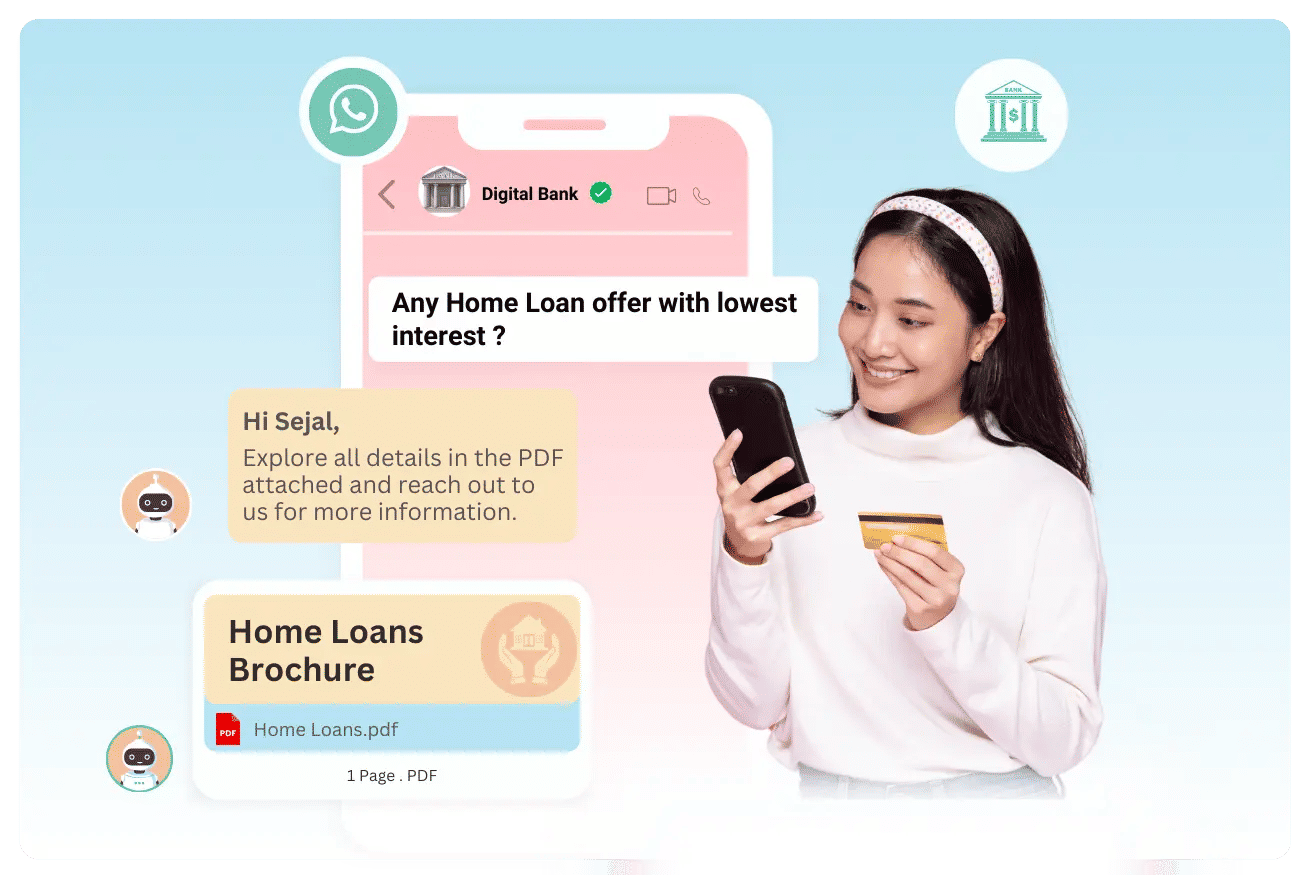

Get the info you need from customers and guide them on what to do next. Share helpful details about your products and services with PDFs and videos.

Register for our Live Demo today and discover why Anantya.ai is the right choice for your business and get answers to all your WhatsApp-related questions.