Table of Contents:

- Introduction

- Why SMS Fallback Is Critical in India

- WhatsApp vs SMS OTP: A Data-Driven Comparison

- Cost Analysis: WhatsApp OTP + SMS Fallback

- Security & Compliance Considerations

- Case Study: Fintech Example

- Best Practices for Seamless SMS Fallback

- Choosing the Right SMS Fallback Gateway for OTP in India

- Future Outlook: Beyond WhatsApp & SMS

- Conclusion

- FAQ’s

SMS Fallback for WhatsApp OTP in India — The Complete Guide to Reliable OTP Delivery

Introduction

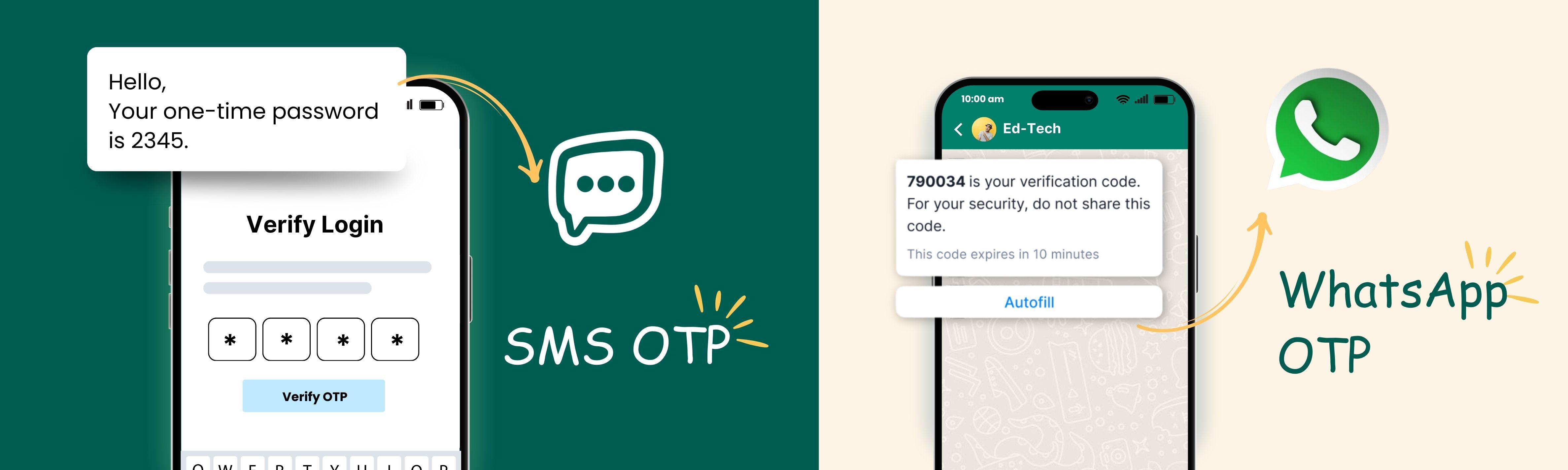

OTP verification is the unseen foundation of India's digital economy, used for everything from bank account login to UPI payments. Despite being the fastest-growing trend, WhatsApp OTP verification cannot ensure 100% delivery.

This is where SMS fallback becomes non-negotiable. SMS fallback is like a backup plan for sending OTPs.

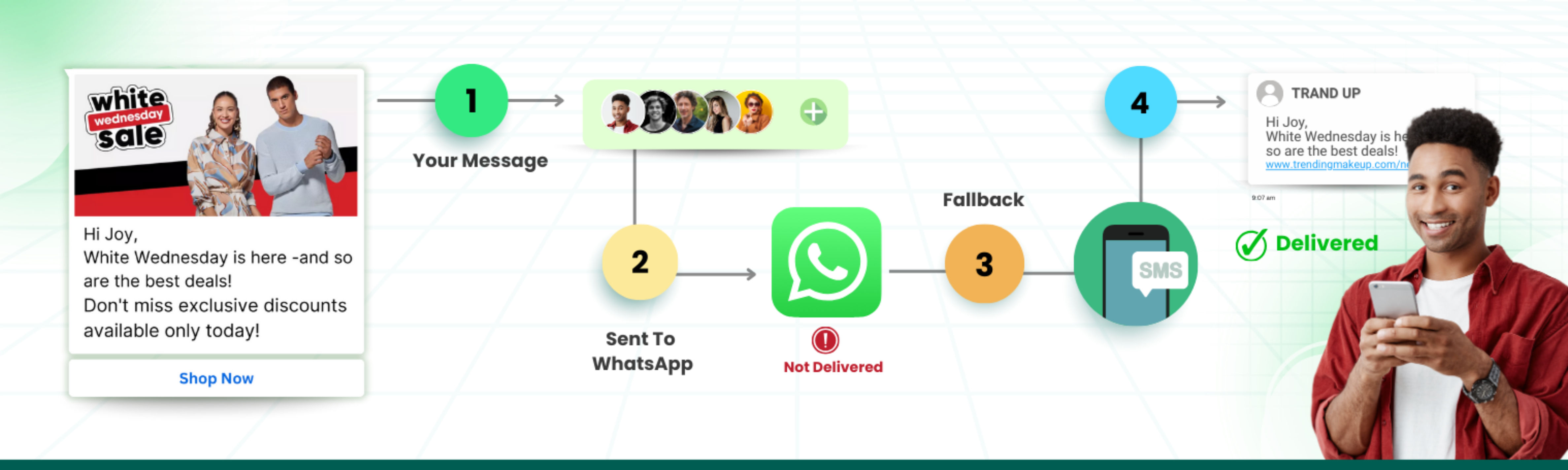

How it works:

- First, the OTP is sent on WhatsApp.

- If it doesn’t reach you (due to no internet, WhatsApp not working, or the number not being registered), the system quickly sends the same OTP by SMS.

- You always receive your code on time and can complete your task smoothly.

In India, where DLT rules, patchy internet, and handset fragmentation create challenges, a hybrid approach ensures OTPs reach every customer, every time.

Why SMS Fallback Is Critical in India

DLT Framework for SMS OTPs

- Mandatory sender ID & template registration.

- Spam filters & delays can cause OTP failures.

- Non-compliant businesses face blocking by operators.

WhatsApp Delivery Bottlenecks

- Works only if the user has internet access + WhatsApp active.

- Network failures in Tier-2/3 cities (where 40% of India’s population resides).

- Device storage issues, uninstalls, or app crashes.

Customer Experience Gap

- Even a 1% OTP failure rate = 10,000 failed logins per million transactions.

- In fintech, this can mean crores lost in transactions.

SMS fallback ensures reliability above 99%.

WhatsApp OTP vs SMS OTP: A Data-Driven Comparison

| Parameter | WhatsApp OTP Verification | SMS OTP India |

|---|---|---|

| Delivery Rate (Urban India) | 90–95% | 85–90% |

| Delivery Rate (Semi-Urban) | 80–85% | 88–92% |

| Speed | 2–3s average | 5–10s average |

| Cost per OTP | ₹0.35–₹0.45 (via WhatsApp OTP API India) | ₹0.12–₹0.20 (via SMS Gateway) |

| DLT Requirement | ❌ | ✅ |

| Security | End-to-end encrypted, verified sender | Prone to SIM-swap & phishing |

| Fallback Need | Critical | Yes (DLT delays) |

Cost Analysis: WhatsApp OTP + SMS Fallback

Think of it this way—if you’re sending one million OTPs a month, most will go through WhatsApp at about ₹0.40 each. That covers around 70% of your traffic and costs roughly ₹2,80,000. For the 30% that don’t make it on WhatsApp, the system falls back to SMS at ₹0.15 per OTP, adding about ₹45,000. Altogether, you’re spending around ₹3,25,000.

Now, if you only used SMS, the cost would be just ₹1,50,000—cheaper, yes, but less reliable. With SMS-only, delivery success sits around 88%. With WhatsApp plus fallback, it jumps to over 99%. That small difference means thousands more successful transactions every month. When you combine it with the 10–15% increase in conversions brought about by WhatsApp's improved user experience, the additional expense soon makes up for itself. In short, fallback is an investment that safeguards income and maintains client satisfaction, not merely an extra expense.

Security & Compliance Considerations

- Phishing Risk: SIM-swap fraud might affect SMS OTPs. WhatsApp OTP adds extra protection via verified business accounts.

- DLT Compliance: SMS fallback must use pre-approved templates to avoid failures.

- Audit Trails: WhatsApp provides encrypted delivery receipts, while SMS provides DLRs (Delivery Reports). Both must be logged for audit readiness.

Case Study: Fintech Example

Consider a fintech company in Mumbai that was struggling with OTP drop-offs. Around 8% of their OTP requests failed due to a mix of WhatsApp connectivity issues and SMS DLT rejections. This led to tens of lakhs in failed transactions each month. After implementing a WhatsApp OTP + SMS fallback gateway, the company achieved 99.5% OTP delivery reliability. Conversions improved by 12%, and although the OTP cost per month increased by 40%, the overall return on investment improved more than threefold due to recovered revenue.

Best Practices for Seamless SMS Fallback

- Trigger fallback fast Don’t make users wait 30 seconds. If WhatsApp fails, send the SMS within a few seconds so the customer isn’t stuck.

- Use the same OTP everywhereThe code sent on WhatsApp should be the same as the one sent by SMS. Different codes confuse people and cause failed logins.

- Work with a direct SMS gateway Avoid middlemen. Partnering directly with telecom operators or trusted gateways gives better speed and reliability.

- Track delivery in real time Keep an eye on OTP delivery. Use analytics to spot delays and automatically switch to the best route.

- Send OTPs in local languages The process gets simplified and more user-friendly by sending backup SMS OTPs in Bengali, Tamil, Hindi, or other regional languages

Choosing the Right SMS Fallback Gateway for OTP in India

Evaluate vendors based on:

- Direct connections with telecom operators This ensures faster, more reliable delivery.

- One API for both WhatsApp + SMS Integration becomes easier if you can trigger WhatsApp OTP and fallback SMS with a single API call.

- Strong SLAs Look for 99.9% delivery guarantees, so you know your OTPs won’t fail..

- DLT compliance built-in Since India requires DLT rules for SMS, the provider should handle this automatically to save you headaches.

Some OTP SMS fallback providers in India are bundling AI-based routing to choose the cheapest yet fastest delivery path.

Future Outlook: Beyond WhatsApp & SMS

RCS (Rich Communication Services)

Think of RCS as a smarter version of SMS. Instead of a plain text with a code, you’ll get an OTP message with your bank’s logo, verified sender ID, and maybe even buttons you can tap. It looks and feels more like WhatsApp but comes straight into your phone’s default messaging app. For users, this means fewer fake messages and a lot more trust. For businesses, it means higher delivery rates without depending only on WhatsApp or old-school SMS.

AI-Powered Verification – No More Waiting

Right now, fallback systems usually wait 10–15 seconds before sending the same OTP via SMS if WhatsApp doesn’t work. That can feel slow when you’re in a hurry. AI changes this. With smart detection, the system can figure out in just a second or two if the WhatsApp OTP will fail—maybe because of poor internet or an app issue—and instantly trigger an SMS. The user doesn’t even notice the switch; they just get their code on time.

Omnichannel Fallback – Always a Plan B (or C, or D)

Today’s fallback is mostly WhatsApp first, then SMS. But the future is all about options. Let's say your OTP tries WhatsApp, then SMS, then a brief voice call reading the OTP aloud, and finally, if none of the other methods work, an email. This ensures that you always receive your code regardless of your location or network. It is similar to having several safety nets to ensure that clients are never caught in the middle of a transaction.

Create Your Anantya.ai Account

Conclusion

India’s OTP ecosystem is evolving fast. While WhatsApp OTP verification delivers a superior customer experience, SMS fallback is the safety net that guarantees reliability.

Businesses that implement a smart SMS fallback gateway for OTP in India will see:

- 99%+ OTP delivery.

- Higher conversions.

- Improved trust & compliance.

In a market as large and diverse as India, this hybrid approach is no longer optional — it’s mission-critical.

Because of DLT rules on SMS, network failures, and patchy internet connectivity in semi-urban regions, OTP delivery can fail. SMS fallback ensures customers are not locked out of transactions.

Yes, but the ROI is positive. Even if costs rise by 30–40%, the revenue recovered from improved OTP delivery and transaction completion far outweighs the expense.

DLT compliance is mandatory for SMS in India. OTP SMS templates and sender IDs must be registered to avoid blocking by operators. A compliant fallback provider ensures smooth delivery.

Yes. Advanced fallback systems can be configured to fall back to SMS first, then to voice OTP or email, creating a fully omnichannel verification flow.

Table of Contents:

- Introduction

- Why SMS Fallback Is Critical in India

- WhatsApp vs SMS OTP: A Data-Driven Comparison

- Cost Analysis: WhatsApp OTP + SMS Fallback

- Security & Compliance Considerations

- Case Study: Fintech Example

- Best Practices for Seamless SMS Fallback

- Choosing the Right SMS Fallback Gateway for OTP in India

- Future Outlook: Beyond WhatsApp & SMS

- Conclusion

- FAQ’s